Looks like

we got a “buy the rumor, sell the news” price development. I have noticed same

pattern for other tokens: announcement, excitement and higher price, event

happening but few new wallets, price drifting lower and last, calls for

marketing.

I think

marketing is a tricky question, will there be any new purchases from people

planning to hold SLT right now? On the other hand, a risk of waiting for the

crypto bear market to turn is that it might by difficult to be seen in the

crowd of crypto projects marketing at the same time. Right now, I’m in the camp

to not to spend any marketing money and focus on the ABTs and get the trading

of them set up.

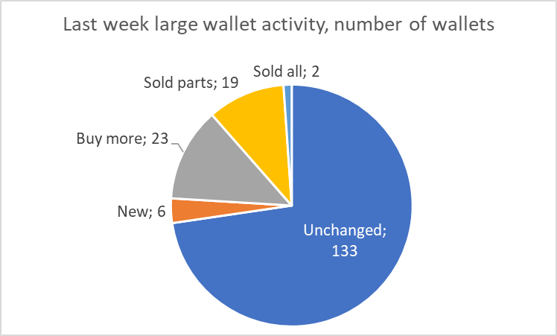

There have

been some interesting moves among the large wallets:

- The #1 rank wallet have sent 20k to the Bitrex wallet adding to the previous 9k ([Bittrex]GB6YPGW5JFMMP2QB2USQ33EUWTXVL4ZT5ITUNCY3YKVWOJPP57CANOF3)

- Rank #4 moved 19k to what looks like a trading wallet but only 2k was sold out

Beside

above, about the same numbers as last week.

Next update

will come when I see something interesting, so no update, no major changes.

Total assets holders and new wallets

Large wallet analyzes

Index

calculated as weekly wallet change quantity divided over unchanged quantity,

e.g. this week change (New 39.768 + Buy more 35.019 + Sold parts 64.048 + sold

all 9.662) divided by Total 6.496.696 = 2,29%.

Top 10 wallets & key individual wallet changes

Among top

10, rank 1, 4 and 5 decreased their holdings. #1 was moved to the Bitrex wallet

and that was the largest increase and second largest increase was the receiving

wallet from #4.

Changes in large wallets from December 10 to today

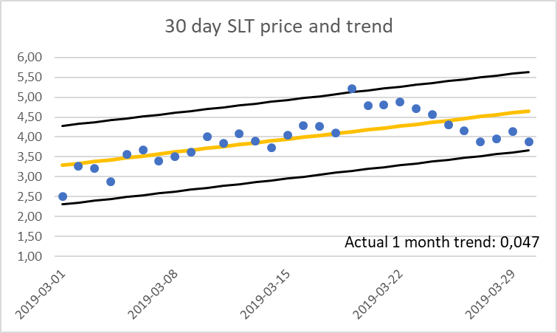

Price and volume analyze

Upper and

lower bounders calculated as 95% probability to be within this range, based on

the standard deviation for the period.

Graph below

shows the 30-day trend value for last 6 months, trend above 0 indicates higher

trend, below decreasing price trend.

SLT

velocity calculated as Weekly trading volume/average weekly SLT price (to

express the trading volume in SLTs) * 52 (to annualize the volume) divided by

Total SLT and Non HODL quantity.

Data

sources:

Inga kommentarer:

Skicka en kommentar