I wrote

some months ago about the risks I saw in Smartlands (here) and I would say they

to some extent are playing out. Quotes from original text and some comments:

- “Most start-ups run into same finding; the initial time plan and budget was too optimistic. How patient are our unknown owners and how much funds are they willing to risk?” My impression was the first STO should be early Q1 so a little bit late but not a major issue. I’m still more concerned about the lack of information about who owns Smartlands Ltd and their ability to fund the company for the next 1-2 years

- “All SLT holders might not have same information. Large SLT holders related to the Smartlands team, institutional lenders/borrowers might get more information then retail investors.” So far, no signs of large selling’s or buying among the top holders

- “Slow adoption rate for ABT in the investment world. For Smartlands to grow rapidly, the ABT needs to attract the middleclass savers and institutional money”. Would say this is in play and a major issue. I was sure they had an underwriter for the first STO who would take what was not crowdfunded but don’t look like that

- “Smartlands is targeting high yield investments.” I was surprised on the yield on this first STO, how come the borrower could not find funding to a lower interest rate?

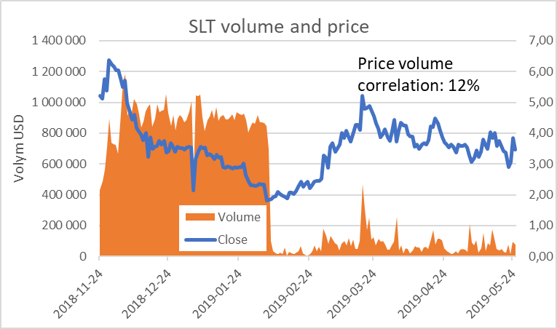

- “I see two short term risks, first the crypto bear market pushing down the overall crypto interest and the second risk in “buy the rumor, sell the news”-event”. Well, the bear market seem to be over but tokens and especially not SLT are not going anywhere, what need to happen for the SLT to take off?

I’m happy

to see the marketing team joining and the listing of the SLT on more major

exchanges, looks like my guess on 2019 plan plays out. Let’s hope they succeed in

bring in

- more STO participants

- more SLT holders

- a higher trading volume

For the large wallets (>3.000 SLT), nothing notable have happened during this last month.

Next update

in a month unless I see something interesting.

Index

calculated as weekly wallet change quantity divided over unchanged quantity,

e.g. this week change (New 56.754 + Buy more 51.358 + Sold parts 54.385 + sold

all 44.627) divided by Total 6.484.920 = 3,19%.

- Among top 10, rank 4 bought back most of what she sold in April, +19k in May and net -1,3k over the last two months.

- Largest sell had rank 20 in April update, she sold another 40k during May and have now only left 20k out of 145k when I started to track mid-December

- Largest buy is 35k in a wallet starting to buy end January and now have 79k

Upper and

lower bounders calculated as 95% probability to be within this range, based on

the standard deviation for the period.

Graph below

shows the 30-day trend value for last 6 months, trend above 0 indicates higher

trend, below decreasing price trend.

Index

contains 19 tokens equal weighted, starting date December 15, BitCoin low after

2017 peak.

SLT velocity calculated as Weekly trading volume/average weekly SLT price (to express the trading volume in SLTs) * 52 (to annualize the volume) divided by Total SLT and Non HODL quantity.

SLT velocity calculated as Weekly trading volume/average weekly SLT price (to express the trading volume in SLTs) * 52 (to annualize the volume) divided by Total SLT and Non HODL quantity.

Data

sources:

Inga kommentarer:

Skicka en kommentar